do you pay california state taxes if you live in nevada

It is true that in Nevada you do not pay tax on that income but California can tax you. June 6 2019 831 AM Yes you need to file a non-resident state return for the California income.

Get Ready To Pay Sales Tax On Amazon Amazon Sale Sales Tax Amazon Purchases

Illinois has an agreement with Iowa Kentucky Michigan and Wisconsin.

. 34 Votes It depends. 395 425 Views. That means Californians pay substantially more property tax than Nevadians.

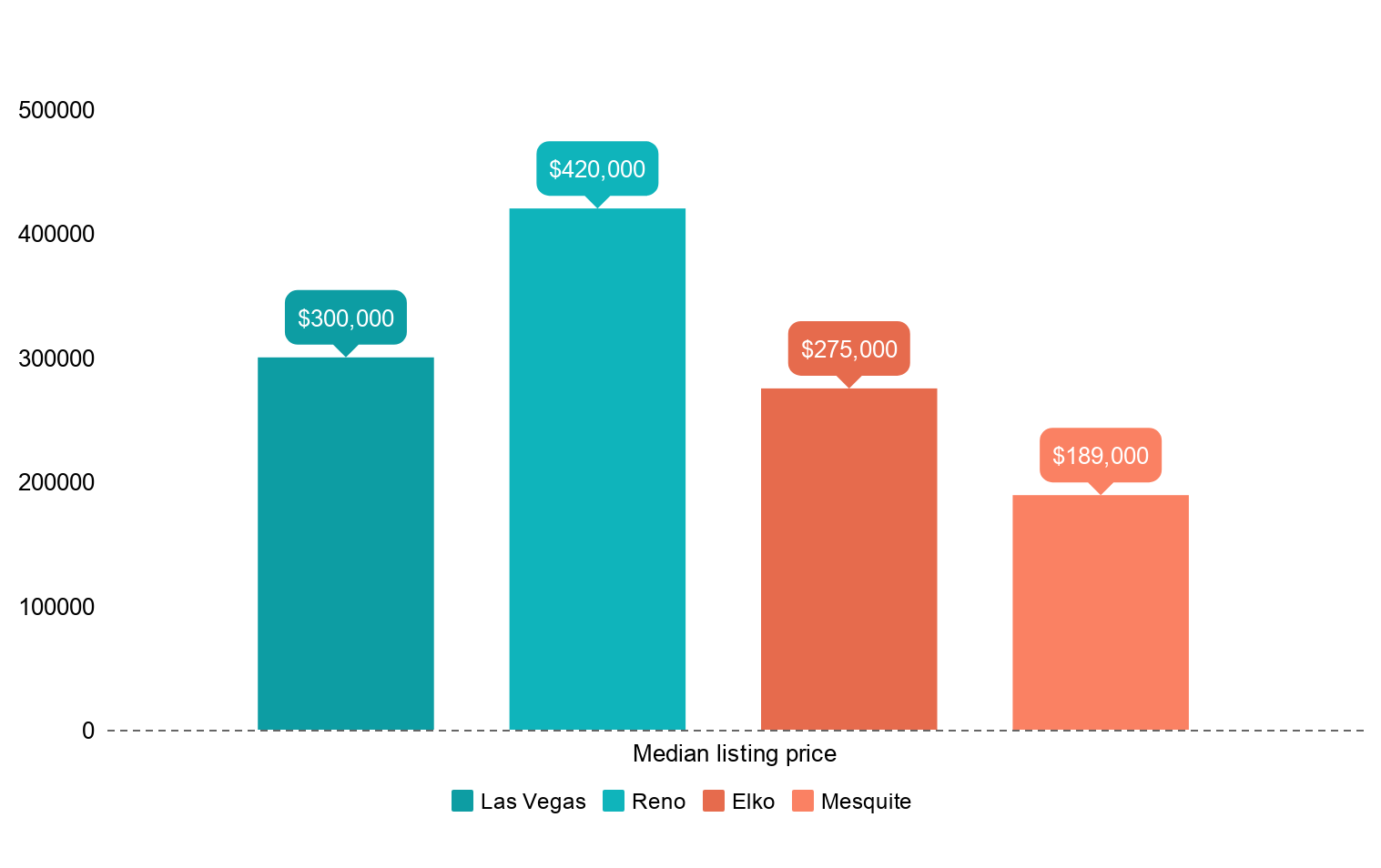

Consumers in California are hit with a sales tax of 725. Local sales taxes increase this total with the largest total rates hitting 105. Nevada property taxes one of the lowest in the nation average 077 of the assessed land value.

However even though you do not live in California you still must pay tax on income earned in California as a nonresident. The minimum wage in Nevada is 725. The state of California requires residents to pay personal income taxes but Nevada does not.

As a resident we have no state income tax if you earn your money in Nevada or if you have passive income even if it comes from California. Alaska Florida Nevada South Dakota Texas Washington and Wyoming. If you work for a California company chances are you will pay California taxes despite the fact that you live in a no-tax state like Nevada.

If you hold residency in California you typically must pay California income taxes even if you earn your living in Nevada. They are Alaska Florida Nevada South Dakota Texas Washington and Wyoming. California Filing Requirements The FTB requires California residents to pay state income taxes regardless of where they earn their money.

Yes you are correct. Follow this TurboTax FAQ to file the non-resident return. If you are a resident of Nevada and are employed in California you will be taxed by California.

You wont need to pay AZ state taxes if you work there but live in CA IN OR or VA. Arizona has an agreement with California Indiana Oregon and Virginia. The second rule is that California will tax income generated in the state regardless of where you live.

How long do you have to live in Nevada to be considered a resident. 79 and in Nevada its. 7 states currently have no income tax.

You will want to file the non-resident first and then your Nevada state return so that your state return can be calculated correctly against any credit from the non-resident CA state return. You will have to prove that you are not a California resident and prove that you didnt put one toe into California for. You will have to pay California tax on your distributive share of the companys LLC income despite the LLC having earned all of its income outside of California say another state like Nevada.

Assume there is no Nevada location of the Company. My experience has shown me that if it is Primary than the tax advantages can be more substantial. Youll pay state income tax in both the state you work and the state you live provided both states have an income tax.

California is known to chase people who leave and to disagree about whether they really are non-residents. Californias Franchise Tax Board administers the states income tax program. PROPERTY TAXES Property taxes in California are in the range of 11 to 16 of the assessed land value.

Yes you will have to pay federal and state taxes in your home state not to mention in Nevada Jeffrey Hirsch I have extensive experience preparing my clients returns Answered 1 year ago Author has 952 answers and 1385K answer views It depends on how much you win. Hi Even though you live in Nevada which has no state income tax any income you earn in the state of California is taxable to California as California source income. If you are working entirely remotely from Nevada your income is considered sourced in Nevada and you will not have to pay any California income tax or file a state return unless your employer withheld state taxes.

New Hampshire and Tennessee dont charge state income tax on earned income but they do assess income tax on dividends and investment income. The employer should be withholding California state income taxes from your wages. This adds a significant toll to purchases.

If taxes have. Do you pay taxes if you live in Nevada. If youre a resident of one of those states or want to establish residency you need.

You wont need to pay IL state taxes if you work there but live in IA KY MI or WI. Since Californias income tax stretches from as little as 1 to as high as 133 this can be a financially crucial one as well. There are seven states with absolutely no state income tax.

However there are reciprocity agreements and credits that could help offset. Nevadas sales tax is much smaller by comparison. The state sales tax in Nevada is 46 which is 265 lower than its neighbor to the west.

The minimum wage in California ranges from 1050 to 1100 per hour. When it comes to property tax Nevada and California boast similar rates. In California the effective property tax rate is.

While federal law prevents California and other states from taxing pension income of non-residents you may have to pay taxes on this income to. If I work for a California Company and live in Nevada working from home for lets say 300 days of the year and the remaining 65 days I work in the California location of company do I have to pay California state taxes for 365 days or for just 65 days. At the end of the tax year you will file a California nonresident tax return.

This tax requirement applies even if you live in California on a part-time basis. Generally speaking you will be required to pay income tax in California even if your income is derived from employment in Nevada. After all Californias 133.

Click to see full answer.

Nevada Sales Tax Small Business Guide Truic

Top 4 Reasons Why You Should Buy Anthem Las Vegas Homes For Sale Las Vegas Homes Las Vegas Las Vegas Free

State And Local Sales Tax Rates 2013 Income Tax Map Property Tax

Nevada Vs California Taxes Explained Retirebetternow Com

California S Tax System A Primer

Nevada Vs California Taxes Retirepedia

![]()

Understanding And Avoiding California State Taxes

Nevada The New California The Nevada Independent

Does California Tax Income Earned In Other States

Nevada Vs California For Retirement Which Is Better 2020 Aging Greatly

Pros And Cons Of Moving To Nevada From California

Pros And Cons Of Moving To Nevada From California

Pros And Cons Of Moving To Nevada From California

California State Symbols Coloring Page Free Printable Coloring Pages In 2022 State Symbols Flag Coloring Pages California State

Pros And Cons Of Moving To Nevada From California

Nevada Vs California Taxes Retirepedia

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)